Image

Monday I attended the Niagara Community Information Group at the Underground Railroad Heritage Museum.

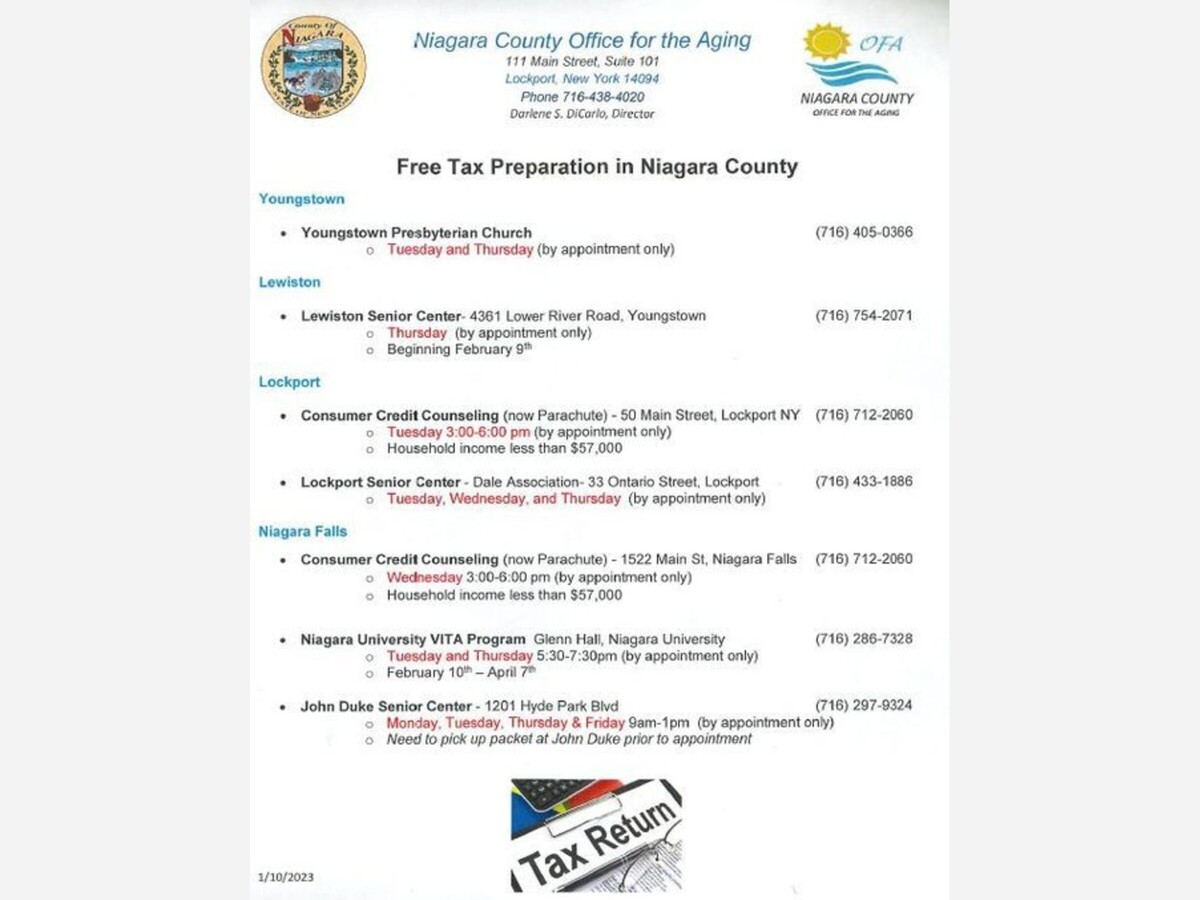

One of the speakers, from Parachute Credit Counseling, Mr. Ingham, spoke about the free tax prep services they offer at Doris Jones Community Center as well as other places (see above).

As an avowed cheapskate, our personal taxes are too complicated to take advantage of a free service. Besides, I kind of enjoy puzzling through the annual process and taking stock of how our businesses did in a 12-month snapshot.

That said, if you don't share my nerd-like fascination with the process, there are good programs available to have your taxes done for free as long as your gross annual income is $68,000 or less. They are listed on the above PDF.

The interesting observation from Mr. Ingham is that for-profit tax prep outfits tend to serve low-income neighborhoods because many people can be charged $100s of dollars because they don’t know any better.

It’s the same as Rent-a-Center where you can buy an $800 couch by paying $4,000 over 3 years.

Ditto the lottery, where the highest sales are inevitably in the most impoverished neighborhoods. I was astonished 30 years ago when I heard that nugget from Assemblyman Arthur Eve who called the Lottery the most racist institution in New York.

And don’t even get me started about buyhere, payhere car lots, check cashing places or cash advance credit cards that let you take an expensive loan before your paycheck comes.

Even those debt consolidation services are often a scam. Often they ask you to let credit card bills go into default while you make payments to the consolidation service. Then, when you are in default and your credit rating is trashed, they negotiate a settlement with your creditors for less than you owe taking a healthy cut of the savings to pay for the service.

I am not a credit counselor or a tax preparer but I have been licensed to sell life insurance and mutual funds since 2005. There are not many circumstances I have not encountered, from Social Security choices to which pension option to take or how to structure income in retirement. Most of that success starts with baby steps. It is a get rich slow scheme.